Restaking on the Lava Network is a key process for those participating in the ecosystem, allowing users to maximize their rewards while contributing to the network’s security and service quality. The Lava Network uses a decentralized model for RPC services, where participants like validators, providers, and delegators play different roles in maintaining the network’s functionality. Restaking allows LAVA token holders to delegate their tokens not just to validators but also to providers, enhancing their earning potential while supporting the infrastructure that powers blockchain interactions. But how to restake LAVA?

In this tutorial, we’ll walk through the step-by-step process of restaking LAVA tokens on the Lava Network, covering the essential actions and providing useful tips for a seamless experience.

Understanding Staking and Restaking on Lava Network

What is Staking on Lava Network? Staking in the Lava Network involves delegating LAVA tokens to validators, who in turn help secure the network and validate transactions. Validators earn block rewards, a portion of which is shared with those who delegate their tokens to them. This process supports the overall security and integrity of the network.

What is Restaking? Restaking goes a step further by allowing delegators to allocate their staked LAVA tokens to data providers. This approach helps direct capital towards specific providers who are critical in serving RPC requests, contributing to the network’s functionality. It offers an opportunity for higher rewards but comes with additional risks due to the reliance on provider performance.

Step-by-Step Guide: How to Restake LAVA

Step 1: Prepare for Staking

Before you can restake your LAVA tokens, you need to complete the initial staking process. Here’s what you’ll need:

- A LAVA-compatible wallet: Ensure you have a wallet that supports LAVA tokens and staking operations. We recommend Keplr Wallet.

- LAVA Tokens: Make sure you have sufficient LAVA tokens in your wallet to delegate. Keep in mind that some LAVA will be required to cover transaction fees. You can swap your other tokens for LAVA in Keplr Wallet.

Step 2: Stake to a Validator

- Log in to your Wallet: Connect your wallet to the Lava Network interface.

- Select a Validator: Navigate to the list of validators available for staking. Review their performance metrics such as uptime and commissions to choose one that matches your preferences.

- Delegate Tokens: Enter the amount of LAVA you wish to delegate to the selected validator. Confirm the delegation to initiate staking.

Step 3: Choose a Provider for Restaking

Once your LAVA tokens are staked with a validator, you can choose to restake these tokens to a specific provider:

- Access the Restaking Portal: Navigate to the Lava Network’s restaking page. Choose a restaking site from the list. Mellifera’s Ping Dashboard is our favorite.

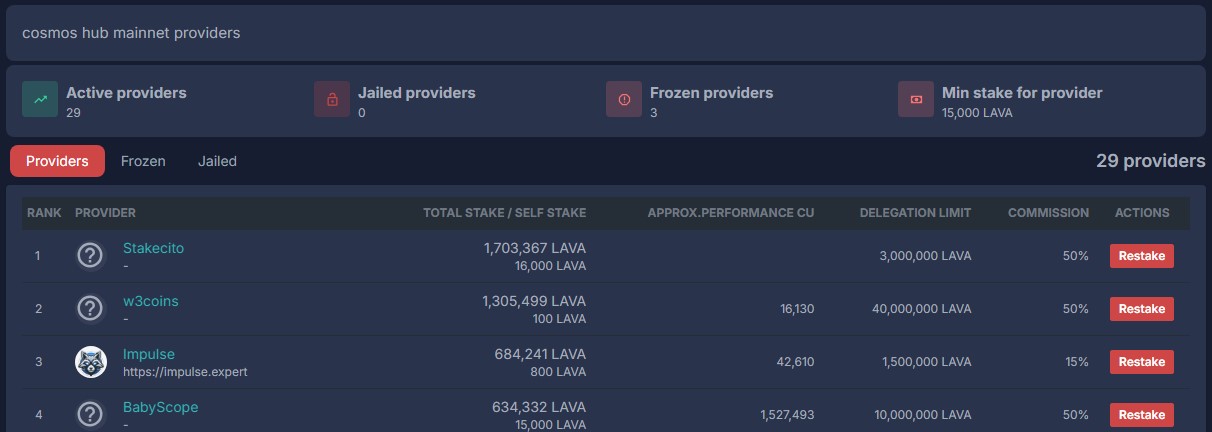

- Select a Provider: Review the available providers who are serving various RPC specs (specific blockchain services). Pay attention to metrics like quality of service, latency, and historical performance.

- Allocate Restake: Specify the amount of your delegated tokens that you wish to restake with the chosen provider. This step allows you to earn additional rewards based on the provider’s performance.

Step 4: Monitor Your Restaking Rewards

After restaking your tokens, you can monitor your earnings through the staking dashboard:

- Track Performance: View the performance of your validator and provider, including how many rewards have been accumulated.

- Adjust Restakes: If necessary, you can adjust your restaking allocation based on provider performance to optimize your returns.

Tips for Restaking LAVA

- Diversify Restakes: Instead of allocating all your restakes to a single provider, consider spreading them across multiple providers to balance risk and rewards.

- Stay Updated with Provider Metrics: Regularly check the performance and reputation of providers to ensure they maintain high-quality service. This can affect your overall earnings.

- Understand Commission Structures: Both validators and providers may charge a commission on the rewards earned. Understanding these structures can help you choose options that maximize your net returns.

Leave a Reply